Multiple debt repayment calculator

This method of repaying. Ad Get Assistance Managing Which Debts to Pay First and How Much to Pay.

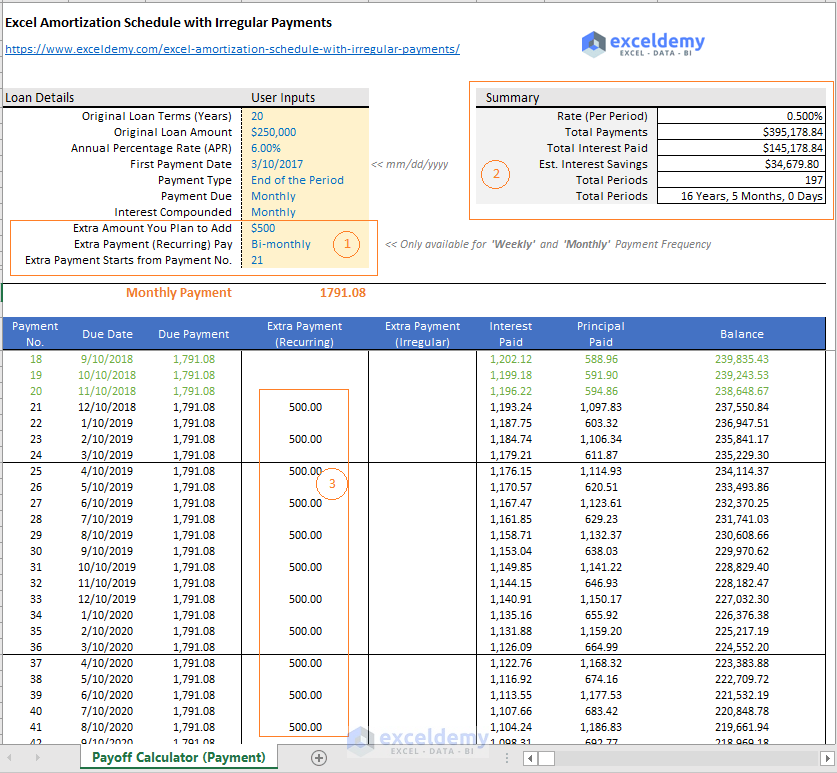

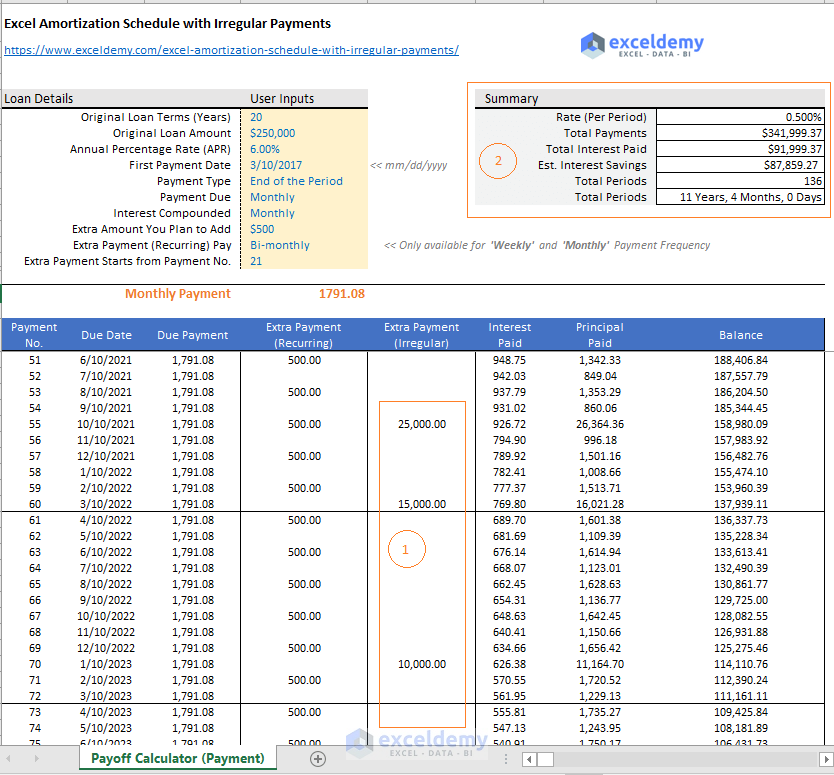

Excel Amortization Schedule With Irregular Payments Free Template

The total cost will equal the annual interest rate multiplied by the loan amount.

. How to use this debt snowball payoff calculator Enter the account name and balance for your various debts such as credit card debt student loans or medical bills in the. Our calculator can help you estimate when youll pay off your credit card debt or other debt such as auto loans student loans or personal loans and how much youll need to pay each. Depending on your goal the right method can lower your monthly payments save you money.

Repayment Calculator The Repayment Calculator can be used for loans in which a fixed amount is paid back periodically such as mortgages auto loans student loans and small business. For this step youll need to input the basic information you collected about your existing debt into the debt calculator including the current balance due interest. 30 year fixed refi.

Ad Reduce Debt With BBB AFCC Accredited Debt Consolidation Companies. Find out how much money and time you can save if you increase the amount of monthly payment you contribute toward a debt such as credit card debt mortgage. The calculator uses this to calculate how long it will take to pay off your debts and how much you will pay in interest.

15 year fixed refi. Use a Debt Repayment Calculator. Enter at least two numbers separated by commas.

Restructuring debts for accelerated payoff. For example if you have credit card bills student loans and. This calculator assumes youll be paying monthly for 10 years once repayment begins which is the standard term for federal loans and many private loans.

Get Step-by-Step Guidance with AARP Money Map. 51 ARM IO 71 ARM. Take Control of Your Debts.

Our Resources Can Help You Decide Between Taxable Vs. How to use Debt Calculator. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

Credit Card Student Loan and Car. The quickest way to retire your debt is to 1 determine what your total debt payment is now then 2 sort your debts from highest interest rate to. You can name each debt whatever you like.

The formula used to calculate the total cost of a loan is fairly straightforward. Our multiple debt payoff calculator can help you determine the best ways to pay off debt. For example if you have credit card bills student loans and auto loans you can name them.

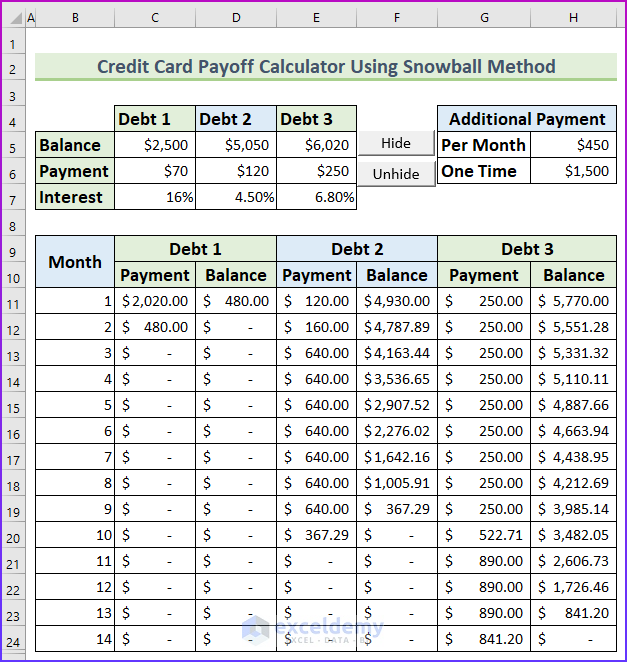

Free Credit Card Payoff Spreadsheet Get Out Of Debt In 2022

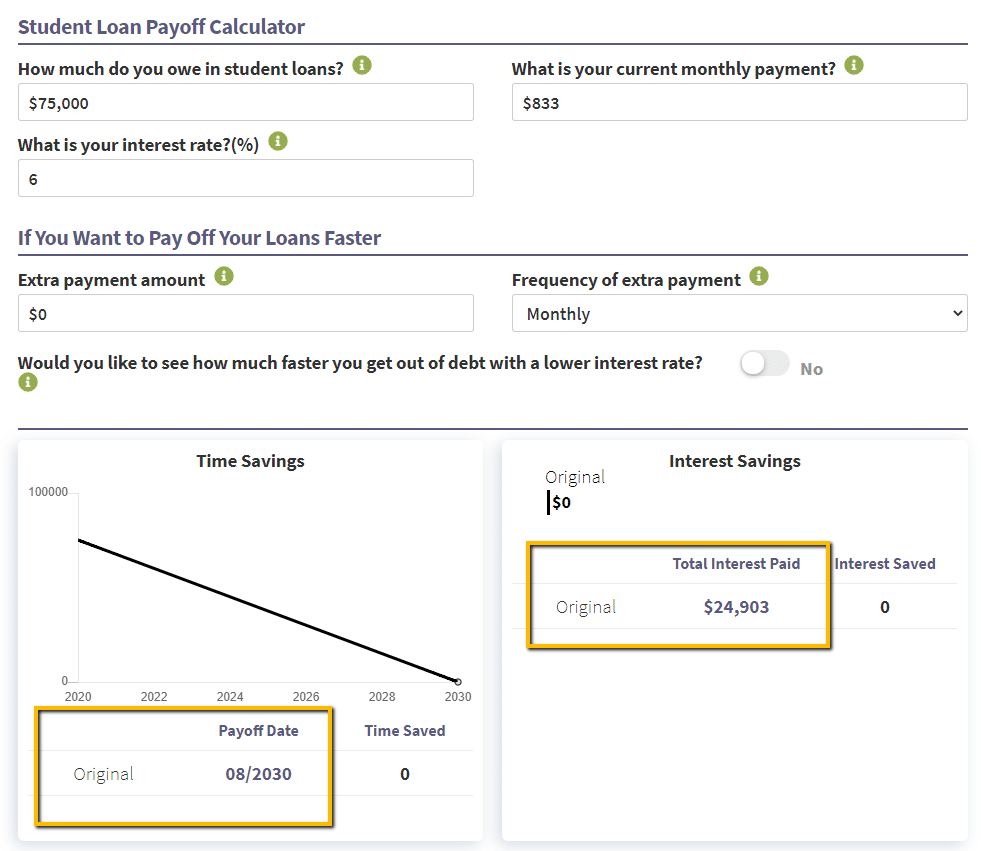

Student Loan Payoff Calculator Updated For 2022 Student Loan Planner

Excel Amortization Schedule With Irregular Payments Free Template

Credit Card Payoff Calculator Excel And Google Sheets Free Download

Debt Payoff Calculator Estimate Your Debt Free Date Credello

A Simple Tool For Creating A Killer Debt Repayment Plan Mom And Dad Money

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

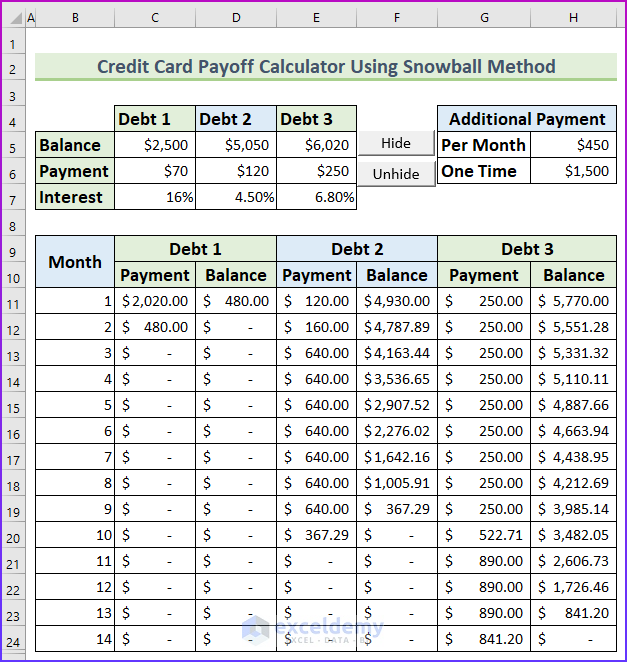

How To Create Credit Card Payoff Calculator With Snowball In Excel

Extra Payment Calculator Is It The Right Thing To Do

Debt Repayment Calculator Credit Karma

A Simple Tool For Creating A Killer Debt Repayment Plan Mom And Dad Money

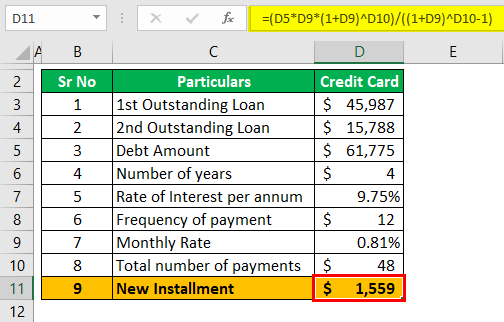

Debt Consolidation Calculator How To Consolidate Your Loans

A Simple Tool For Creating A Killer Debt Repayment Plan Mom And Dad Money

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

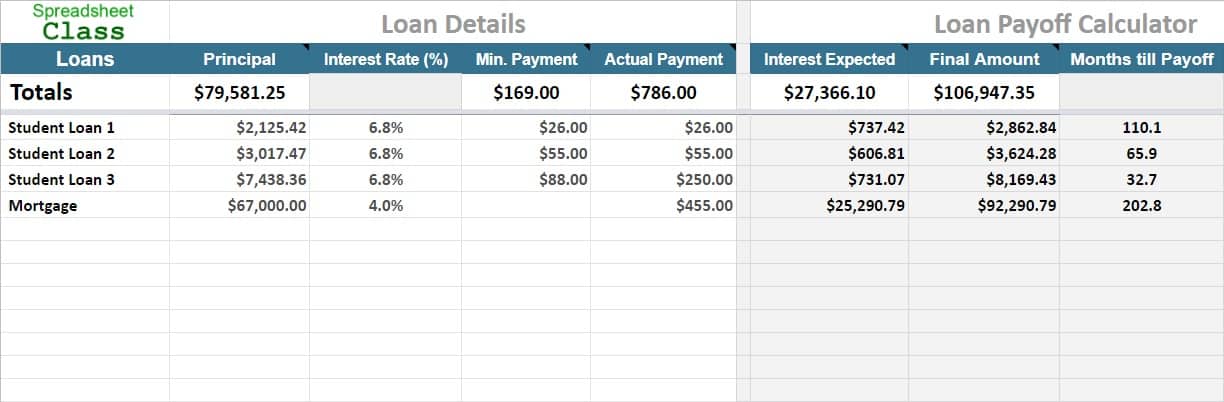

Loan Payoff Calculator Template For Google Sheets

Student Loan Consolidation Calculator Simplify Your Loans Earnest

Loan Repayment Calculator